Debunking Financial Myths

“An investment in knowledge pays the best interest”

In a world where financial advice is as ubiquitous as it is varied, distinguishing fact from fiction is crucial for anyone looking to navigate the complexities of personal finance. My goal is to shed some light on the most pervasive financial myths that, despite their widespread acceptance, often hinder individuals from achieving true financial literacy and success.

By debunking these myths, we empower ourselves with the knowledge to make informed decisions, paving the way for a future of financial stability and well-being.

The More Money I Have, the Happier That I Will Be

While there is a link between money and happiness, it's not necessarily strong. Millionaires aren't always extremely happy. Having more money doesn't shield you from life's challenges. Focus on allocating funds wisely to achieve financial control and peace of mind.

I Don’t Need to Save for Retirement Now

This myth can be dangerous. Starting early is crucial because of compounded interest. For example, a 25-year-old investing $200/month at a 6% return will have $393,700 by age 65. Waiting until age 35 yields only $201,100.

All Debt Is Bad

Not all debt is harmful. Good debt (like a mortgage or student loan) can be an investment in yourself. Evaluate the purpose and interest rates of your debt before labeling it as bad.

Renting Is Throwing Money Away

Renting provides flexibility and avoids property maintenance costs. Owning a home involves expenses like property taxes, maintenance, and interest on the mortgage. It's not always a better financial choice.

Investing Is Only for the Wealthy

Anyone can invest, regardless of income. You can always start small and gradually increase your investments. Compound growth over time benefits even modest investments.

Credit Cards Are Evil

Credit cards can be useful if used responsibly. They can help you build credit and offer rewards. The key is to pay off balances in full each month and avoid high-interest debt.

You Need a High Income to Build Wealth

Wealth-building depends on saving, investing, and living within your means. Consistent habits matter more than a high income.

Investing in Stocks Is Like Gambling

Investing involves risk, but it's not akin to gambling. You can lower your risk by diversifying your portfolio and investing for the long term. Educate yourself and make informed decisions.

I Can Time the Market

Market timing rarely works. Trying to predict short-term fluctuations can lead to frustration and losses. Focus on a long-term investment strategy instead.

I’m Too Young to Think About Estate Planning

Estate planning isn't just for the elderly. It ensures your assets are distributed according to your wishes. Create a will, set up a living trust, designate beneficiaries, and consider protection planning regardless of your age.

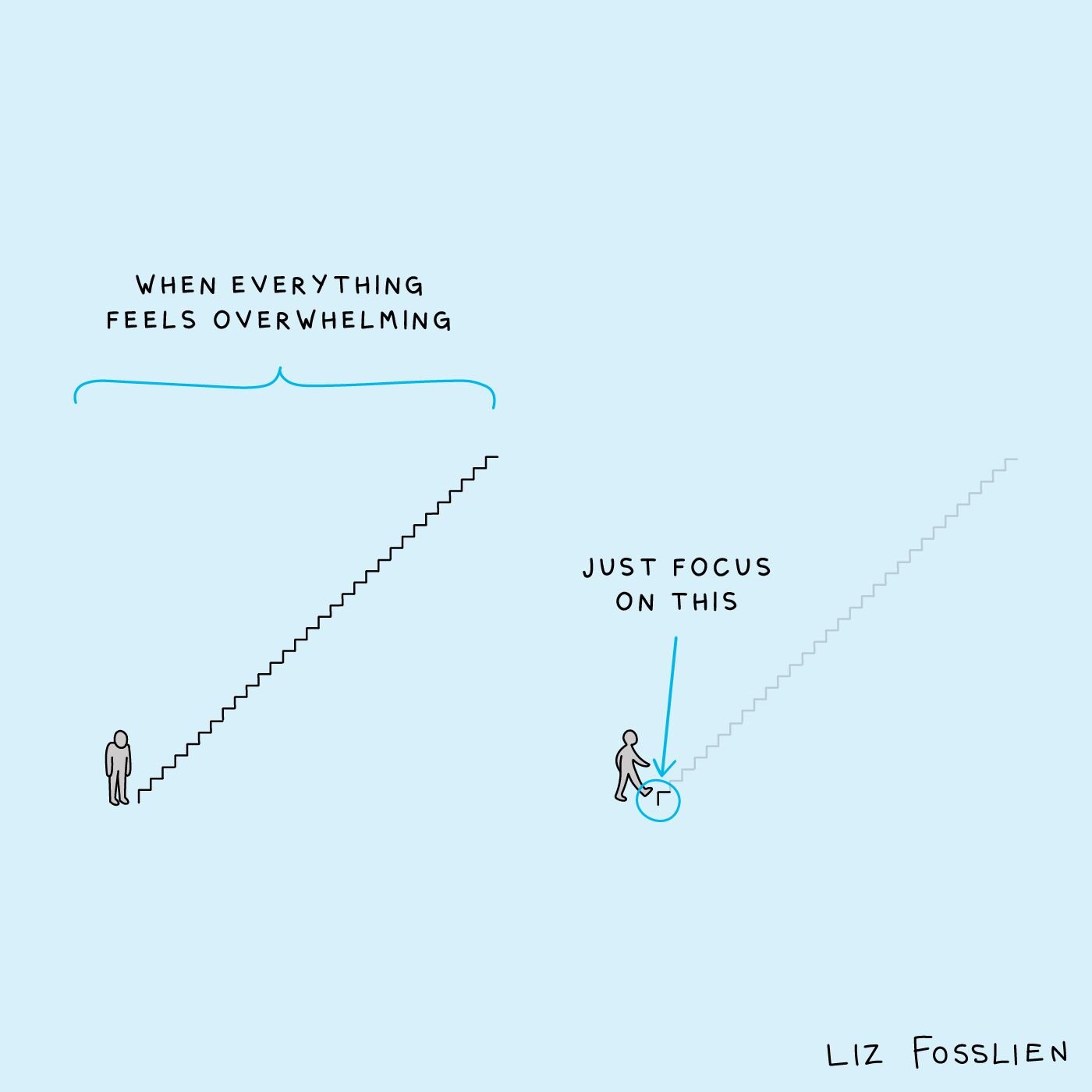

Visual Credit: Liz Fosslien

Action Items

All these financial myths can feel overwhelming. Let’s help you take the first step today and not let these myths dictate your financial future. In order to make informed financial decisions, consider the following action steps:

Educate Yourself: Increase your financial literacy by reading books, attending workshops, or using online resources to understand the basics of personal finance.

Create a Financial Plan: Develop a comprehensive financial plan that includes budgeting, savings, investments, insurance, and retirement planning.

Consult Professionals: Seek advice from certified financial planners or fiduciaries who are legally obligated to act in your best interest.

Take Ownership: Realize that while advisors can guide you, the ultimate responsibility for your financial well-being lies with you.

Use Technology: Utilize financial planning platforms, such as WealthCompass, to track and manage your finances effectively.

Start Investing Early: Begin investing as soon as possible to take advantage of compound interest and grow your wealth over time.

Avoid Debt Traps: Pay off credit card balances in full to avoid high-interest rates and maintain a good credit score.

Prepare for Emergencies: Build an emergency fund to cover unexpected expenses and provide financial security.

By following these steps, you can navigate the financial landscape with confidence, debunk myths, and take control of your financial future. Share this article with friends and family to spread the knowledge, and together, let’s build a financially savvy community.

~Alex

Whenever you’re ready, there are 3 ways I can help you!

Organize Your Money Course: Are you ready to take control of your financial future, instead of letting it control you? This course will help relieve your financial anxiety and get you back on track.

Book a 1-on-1 Meeting: Whether you’re looking for assistance with your financial planning needs or are in the financial industry and you want to learn how to grow your practice, I can help.

Lake Avenue Financial: If you’re looking to build a relationship with a team who can help simplify, educate, relive the stress caused by money decisions and make sure you are on your way to financial independence, we are here to help!

Be Inspired to take Action

Join over 5,000 readers of the Inspire Action newsletter for tips, uplifting stories and actionable steps to guide you through your financial journey.