Finding Your Path

“Getting lost along your path is a part of finding the path you are meant to be on.”

When I started college, I thought I wanted to be an accountant. I was good at numbers and liked being around business owners and entrepreneurs. I signed up for an accounting class and really enjoyed it.

I was working part time at a bank while I attended school. I learned a lot while I was there. But I realized that if I wanted to be in the accounting industry, I should look for a job at a CPA firm. Nothing fancy, but a position that would get me in the door and hopefully I could soak up as much as I could from the other accountants.

Luckily there was a firm near my school that was looking for a file clerk. I went to the interview and was quickly hired. After my morning classes, I would head over to the office and on my desk would be a pile of tax returns and other items that I had to either file away in the client’s tax binder or shred. Keep in mind that this was back in 1995, before items were being scanned. Most firms had large offices and half of it was to store client files in large metal cabinets.

The best part of my job was chatting with the accountants and the firm partners who would stop by my desk to drop off items for me to file. One of the partners there, Roger, really took a liking to me. My desk was directly across his office, so he would spend a few minutes chatting with me whenever he saw that I was in the office. I really enjoy our conversations.

They used to have a copy of the Wall Street Journal in the lobby, and I would often see Roger reading it. I had just started investing in some stocks and mutual funds myself with the extra money I was making. So most of our conversations revolved around investments and the economy. He seemed to be impressed by how much I knew about Wall Street as a 19 year old. We would share what stocks we were buying and what was on our watch list.

As time went on, Roger asked me why I was interested in becoming an accountant. Frankly, that was a question I was starting to ask myself. I realized that many of the accountants at the firm were not too happy, and were especially stressed out during tax season. They dealt with many corporate clients, so every quarter was extremely busy.

Roger said, “You know a lot about investments and the stock market, maybe you should look into that field when you graduate from college.” I didn’t really think much of his comments at the time. I figured accounting was a good field and your career wasn't necessarily supposed to be fun. So I continued on my path.

A year later I transferred to UC Santa Barbara and had to quit my clerk job that was in Los Angeles. While I was there, I continued to invest and learn more about the markets and the economy during my off time. I was away from my family, so I had a lot of time to do some soul searching. I was starting to realize that being an accountant wasn’t something I could see myself doing for the rest of my life.

In 1997, I decided to pursue a career in financial services. I was 21 years old at the time, but I wanted to give it a shot. I recognized that I had nothing to lose. If I didn’t try, who knows where I would’ve been today. More importantly, I would’ve probably been living with regret for the rest of my life. Wondering what could’ve been.

It’s been almost 27 years since I made that decision and followed this path. A decision I’m glad I made.

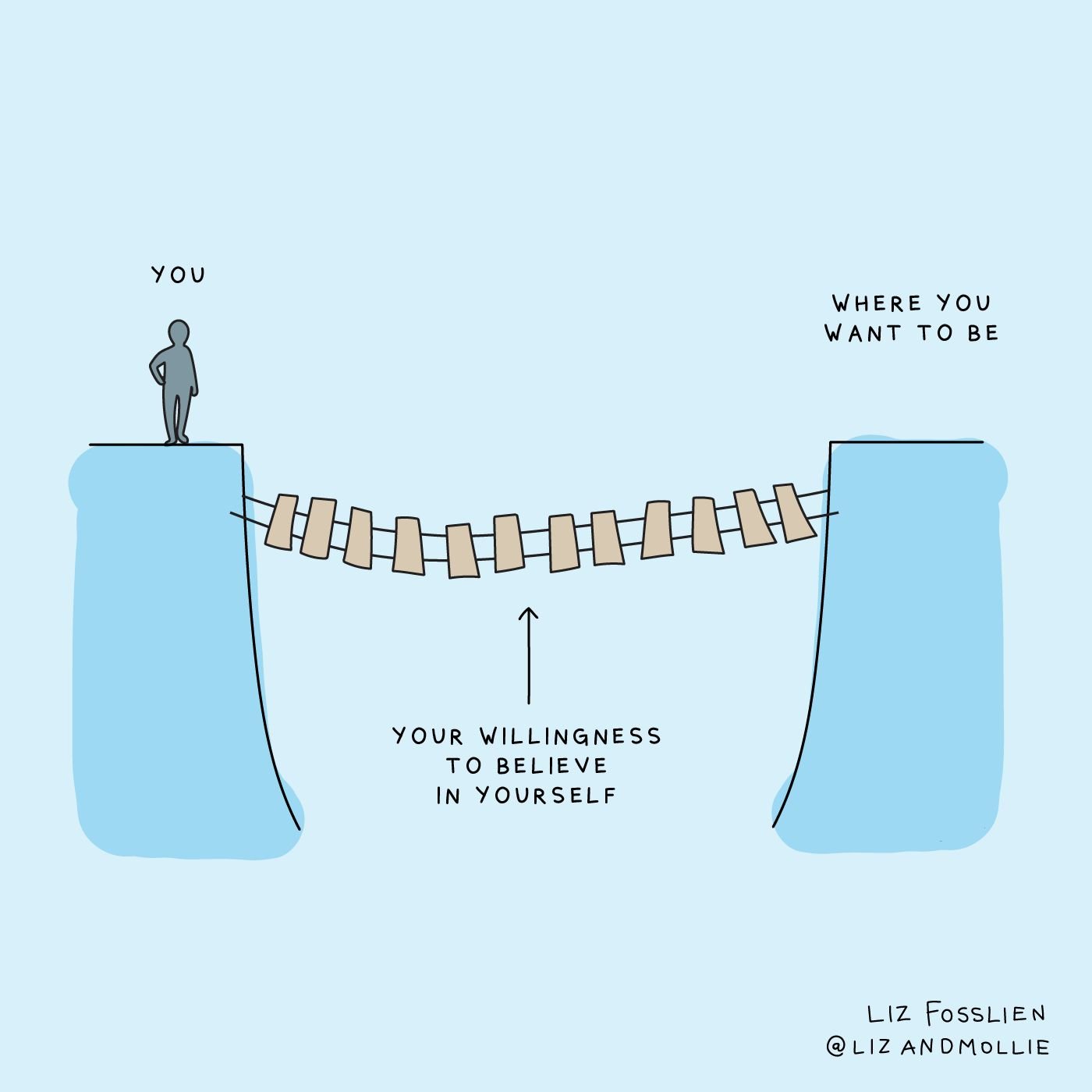

Visual Credit: Liz Fosslien

Action Items

Finding your path in life is a deeply personal journey, and it often involves a combination of self-discovery, exploration, and growth. Here are some suggestions to help you find your path:

Self-Reflection: Take time to reflect on your values, interests, and experiences. Consider what brings you joy and fulfillment.

Explore Your Passions: Passion can be a powerful motivator. Think about the activities that you love doing and how you can incorporate them into your career or daily life.

Set Goals: Having clear goals can provide direction and a sense of purpose. They can be short-term or long-term, but they should be meaningful to you.

Seek Guidance: Don't hesitate to seek advice from mentors, coaches, or individuals you admire. They can offer valuable insights and support.

Embrace Failure and Adaptability: Understand that failure is a part of the learning process. Be open to change and willing to adapt as you discover more about yourself.

Listen to Your Intuition: Sometimes, your gut feeling can guide you towards choices that align with your true self.

Stay Persistent and Patient: Finding your path is not always quick or easy. Be patient with yourself and persistent in your efforts.

Experiment and Learn: Life is full of opportunities to learn. Try new things, take risks, and be open to where life takes you.

Remember, there's no one-size-fits-all solution, and your path may change over time as you grow and evolve. It's important to stay true to yourself and make choices that align with your personal definition of success and happiness. Good luck on your journey!

~Alex

Whenever you’re ready, there are 3 ways I can help you!

Organize Your Money Course: Are you ready to take control of your financial future, instead of letting it control you? This course will help relieve your financial anxiety and get you back on track.

Book a 1-on-1 Meeting: Whether you’re looking for assistance with your financial planning needs or are in the financial industry and you want to learn how to grow your practice, I can help.

Lake Avenue Financial: If you’re looking to build a relationship with a team who can help simplify, educate, relive the stress caused by money decisions and make sure you are on your way to financial independence, we are here to help!

Be Inspired to take Action

Join over 5,000 readers of the Inspire Action newsletter for tips, uplifting stories and actionable steps to guide you through your financial journey.