Guide to Credit Card Debt

“I had plastic surgery last week. I cut up my credit cards.”

It was my first day of college, and I had just finished my morning classes and was walking through campus to have lunch. I noticed a table with a few students filling out a form. As I walked closer, a young woman that was working at the table asked me if I would like to apply for a credit card.

I really wasn’t sure what a credit card was, as I grew up in a house where my parent’s predominantly paid for things in cash. I had seen credit cards before at my grandparent’s restaurant, but didn’t understand how they worked.

She noticed the puzzled look on my face and said, “If you sign up, we’ll give you a pen.” Well, I guess I can use a pen for school. “Sure, sounds good,” I replied. I filled out the application and a few weeks later I received my first credit card. It was a Citibank card with a $300 credit limit.

Woohoo! $300!! I couldn’t wait to use it. I called the 800 number to get it activated, and was off to the mall. Don’t forget, it was 1994 and the mall was still a cool place to go.😉

I treated my friends at the food court, then we walked around and I bought some clothes. After all, I needed a few new items for college. Then off to the music store to pick up a few CDs I was looking for. While I’m at it, why not a new CD player? I deserve it, right??

Before I knew it, my card was maxed out. But that was just the beginning of my problems. A month later I got the credit card statement, and had no idea how I was going to pay it off. The individual who got me to sign up for the card told me how to use it to buy stuff, but never explained how I should plan to pay for any of it.

It took me months to pay off that card, but I learned a great lesson.

History of Credit Cards

You might not be able to imagine a world without credit cards, but it wasn’t that long ago that credit cards began to gain widespread popularity. The first known credit card was created in 1914 when Western Union began to issue metal plates, called “Metal Money”, to a select group of their customers.

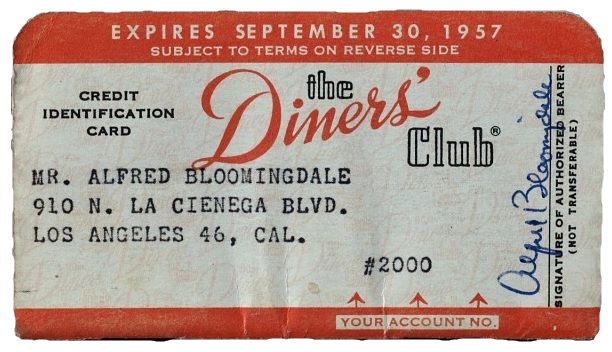

But it wasn't until the 1950s when the Diner's Club card was launched after its founder forgot his wallet while at a restaurant. The Diner’s card became an easy way to pay for restaurant meals without cash.

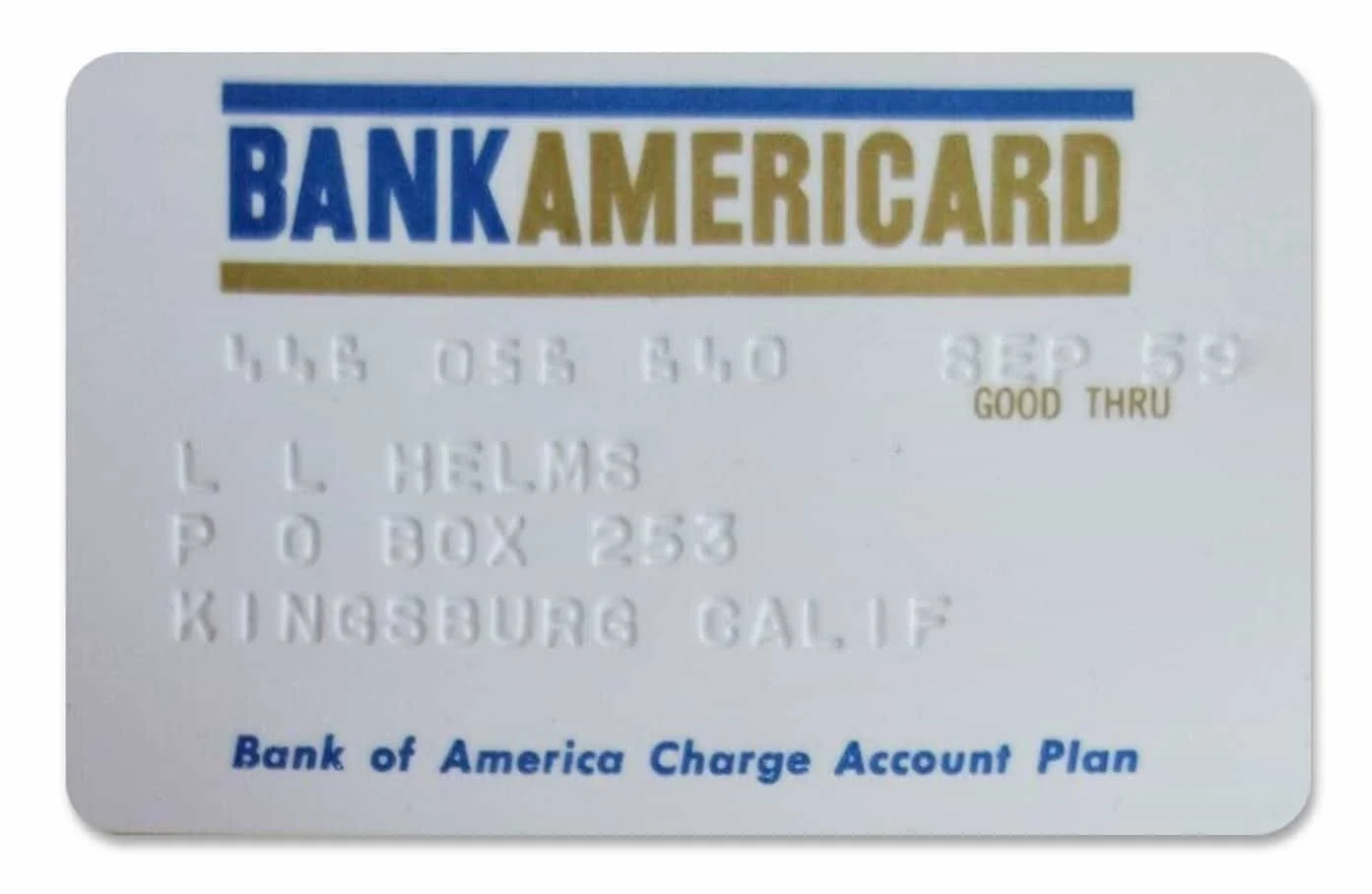

Then in 1958, American Express launched its first charge card followed by the Bank of America which issued the first revolving credit card, the BankAmericard, to 60,000 people in Fresno, CA.

BankAmericard later split off and became the Visa that we know today, paving the way for credit cards to become one of the most common forms of payment in the world.

Responsible Usage

While credit cards can be a convenient way to make purchases, they can also be a source of debt if not used responsibly. According to a recent study, the average American household has over $8,600 in credit card debt. If you're struggling with credit card debt, there are a number of strategies you can use to address and overcome it.

Common Credit Card Mistakes

Before we discuss strategies for tackling credit card debt, let's take a look at some of the most common credit card mistakes:

Carrying a balance from month to month: This is one of the biggest mistakes you can make, as it will result in paying interest on your debt.

Maxing out your credit cards: This can damage your credit score and make it difficult to get approved for loans in the future.

Only making the minimum payment: This will only prolong your debt and make it more difficult to pay off.

Using credit cards for frivolous purchases: It's important to only use your credit card for essential purchases that you can afford to pay off in full each month.

Not understanding the terms and conditions of your credit card: This can lead to unexpected fees and charges.

Strategies for Tackling Credit Card Debt

If you're struggling with credit card debt, there are a number of strategies you can use to tackle it:

Make a budget and stick to it: This will help you track your spending and ensure that you're not overspending.

Cut back on unnecessary expenses: Take a close look at your budget and see where you can cut back on spending.

Make extra payments on your credit cards: This will help you pay down your debt faster and save money on interest.

Consider a debt consolidation loan: This can be a good option if you have multiple credit cards with high interest rates.

Seek professional help: If you're struggling to manage your credit card debt on your own, you may want to consider seeking professional help from a credit counselor or financial advisor.

Tips for Responsible Credit Card Usage

If you want to avoid credit card debt in the future, there are a number of things you can do:

Only use your credit card for essential purchases: This will help you avoid overspending and getting into debt.

Pay off your balance in full each month: This will help you avoid paying interest on your debt.

Set a spending limit for yourself: This will help you control your spending and avoid overextending yourself.

Regularly review your credit card statements: This will help you catch any errors or unauthorized charges.

Monitor your credit score: This will help you stay on top of your credit health and identify any potential problems.

Remember, tackling credit card debt requires discipline, commitment, and a willingness to make changes. By implementing these strategies and seeking support when needed, you can successfully manage and overcome credit card debt, paving the way for long-term financial stability.

~Alex

Whenever you’re ready, there are 3 ways I can help you!

Organize Your Money Course: Are you ready to take control of your financial future, instead of letting it control you? This course will help relieve your financial anxiety and get you back on track.

Book a 1-on-1 Meeting: Whether you’re looking for assistance with your financial planning needs or are in the financial industry and you want to learn how to grow your practice, I can help.

Lake Avenue Financial: If you’re looking to build a relationship with a team who can help simplify, educate, relive the stress caused by money decisions and make sure you are on your way to financial independence, we are here to help!

Be Inspired to take Action

Join over 6,000 readers of the Inspire Action newsletter for tips, uplifting stories and actionable steps to guide you through your financial journey.