Trade Wars and Treasuries

“No nation was ever ruined by trade.”

It’s not often we hear about bonds when we turn on the news. While stocks often grab headlines, US bonds play a less flashy but equally critical role in the financial world. These debt instruments, issued by the US government, are seen as a safe haven for investors globally and serve as a benchmark for interest rates worldwide. They are the foundation upon which a vast array of financial products and strategies are built.

Source: SIFMA, World Federation of Exchanges, 2024 data

As the table indicates, the global bond market is colossal, exceeding the stock market in overall value. This highlights the sheer scale of debt financing compared to equity financing. The US Treasury market, a subset of the global bond market, is the largest and most liquid in the world, further emphasizing its significance.

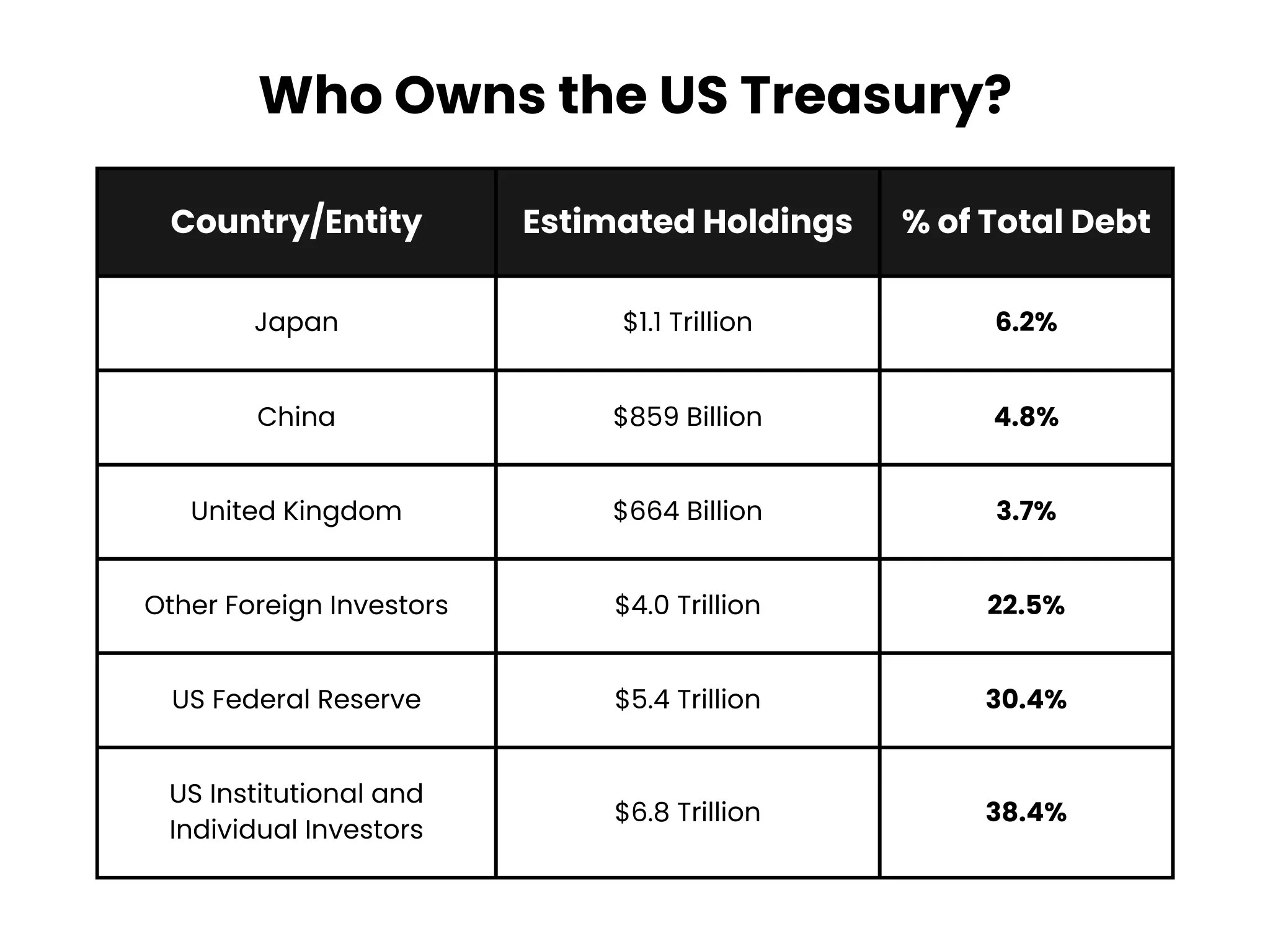

While the US government issues Treasury bonds, a diverse range of entities hold them. Foreign governments, particularly Japan and China, have significant holdings. The Federal Reserve is a major holder as part of its monetary policy operations. Additionally, US financial institutions and individual investors hold a substantial portion of the debt.

On Thursday, April 3rd the US 10 Year Treasury yield hit a low of 3.86% as investors sold stocks and flocked to purchase US debt, which is considered a safe haven during tumultuous times. But by Wednesday, April 9th, the 10 Year yield hit a high of 4.50%. What was going on?? This rapid rise in a week was one of the biggest spikes on record.

It’s important to know that bond prices have an inverse relationship with their yield. So when bond prices go up the yield goes down… and vice versa. What was causing the yield to rise so quickly? Something this administration was trying to avoid!

Well it appears that China and Japan were selling their US Treasury holdings amid the heightened trade tensions. My guess is that this forced Trump to change course and institute a pause on the tariffs for 90 days. Keep in mind that he made this about-face after saying “...MY POLICIES WILL NEVER CHANGE” last week on social media. Not giving investors too much confidence on the trade negotiations.

As much as I don’t want to discuss political figures here, I think it’s really important to understand why I believe that these moves have fractured the trust and relationships the US has with so many countries around the world.

When countries like Japan, who own over $1 Trillion of the US debt, feel like America is no longer a safe place for their money, they start to unwind their Treasury holdings. China, on the other hand, who owns over $800 Billion of US Treasury bonds, is in a heated tariff war with the US. I wouldn’t blame them for selling their US bonds as a way to retaliate during these hostile negotiations. It doesn’t help that this administration has singled them out as enemy number one during these tariff discussions.

Impact of Tariffs on the US Bond Market

Tariffs, which are taxes on imported goods, can have a ripple effect on the US bond market through various channels:

Inflationary Pressures: Tariffs raise the cost of imported goods, potentially leading to inflation. If inflation rises, the Federal Reserve may raise interest rates to curb it.

Interest Rate Dynamics: As the Federal Reserve adjusts interest rates, bond yields typically follow suit. Higher interest rates lead to higher bond yields, which can decrease the price of existing bonds.

Investor Sentiment: Trade tensions and tariff wars can create uncertainty and dampen investor confidence. This can lead to a flight to safety, with investors seeking the relative security of US Treasury bonds.

Currency Fluctuations: Tariffs can impact currency exchange rates, which in turn can affect the attractiveness of US Treasury bonds to foreign investors.

Economic Growth: Tariffs can disrupt global supply chains and hinder economic growth. Slower growth can reduce demand for riskier assets, potentially increasing demand for safe-haven assets like US Treasury bonds.

The recent tariffs imposed by the US have had a mixed impact on the bond market. While some investors have sought the safety of US Treasuries, concerns about long-term economic growth and potential inflation have also weighed on the market.

Action Items

US bonds play a crucial role in the global financial system, providing stability and serving as a benchmark for interest rates. Understanding the dynamics of the bond market, including the impact of policy decisions like tariffs, is essential for investors and policymakers alike.

Given the crucial role of US bonds in the global economy, it's important to take the following items into consideration:

Stay Informed: Keep up-to-date on economic news, particularly regarding bond yields, interest rates, and trade policies, as these factors significantly impact the bond market.

Monitor Treasury Holdings: Pay attention to reports on foreign and domestic holdings of US Treasury bonds, as large shifts can indicate changing investor sentiment and potential market volatility.

Understand Bond Yields: Learn about the inverse relationship between bond prices and yields, and how economic events and policy decisions can influence these metrics.

Consider Diversification: Evaluate your investment portfolio and ensure it is diversified across different asset classes, not solely focused on stocks or other potentially volatile investments.

Follow Trade Policy Developments: Track news related to tariffs and trade negotiations, as these can have significant implications for the bond market and overall economy.

Seek Professional Advice: Lastly, if you have specific financial questions or concerns, feel free to connect with me for personalized guidance.

~Alex

Whenever you’re ready, there are 3 ways I can help you!

Organize Your Money Course: Are you ready to take control of your financial future, instead of letting it control you? This course will help relieve your financial anxiety and get you back on track.

Book a 1-on-1 Meeting: Whether you’re looking for assistance with your financial planning needs or are in the financial industry and you want to learn how to grow your practice, I can help.

Lake Avenue Financial: If you’re looking to build a relationship with a team who can help simplify, educate, relive the stress caused by money decisions and make sure you are on your way to financial independence, we are here to help!

Be Inspired to take Action

Join over 7,000 readers of the Inspire Action newsletter for tips, uplifting stories and actionable steps to guide you through your financial journey.